An Efficient Portfolio Has Which of the Following Characteristics

How do I download my Portfolio Manager data in Green Button format. Efficient market hypothesis does not contradict the existence of policies that give higher profits than market portfolio but which also have a greater risk.

:max_bytes(150000):strip_icc()/ModernPortfolioTheory2_2-48788533579e4739919ec76a33f1ca3d.png)

Modern Portfolio Theory Why It S Still Hip

Pareto efficiency or Pareto optimality is a situation where no individual or preference criterion can be better off without making at least one individual or preference criterion worse off or without any loss thereof.

:max_bytes(150000):strip_icc()/ModernPortfolioTheory2_2-48788533579e4739919ec76a33f1ca3d.png)

. Products are distributed through a network of c800 partners bank networks and IFAs. Benchmark to find out which buildings in your portfolio are the most efficient and then work with the teams at those buildings to replicate energy-saving practices at underperforming buildings. It should be done only as part of a diversified portfolio.

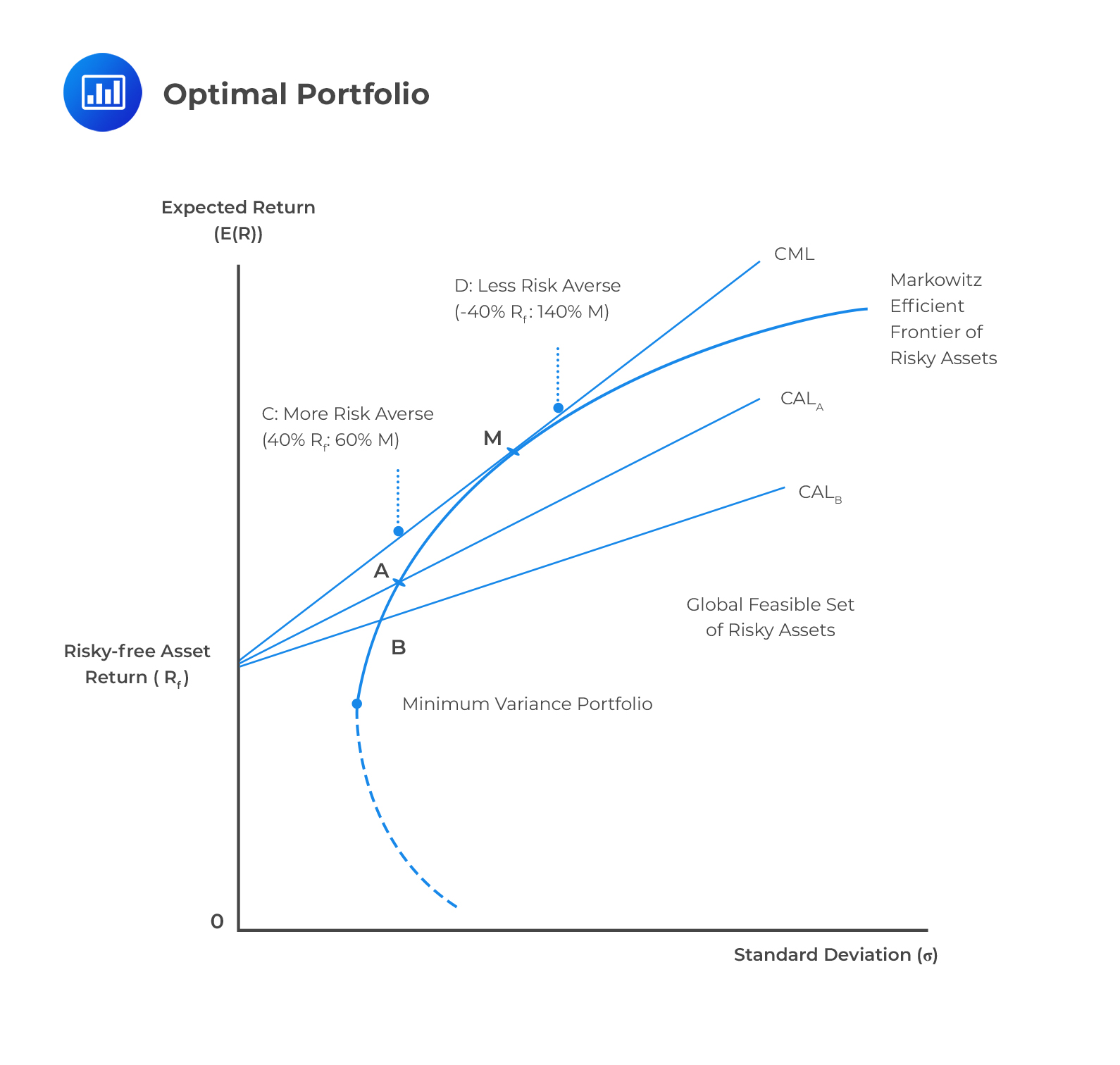

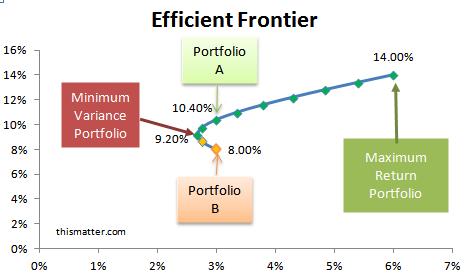

The unsystematic risk is the controllable variation in earnings due to the peculiar characteristics of the industry and company management efficiency consumer preferences labour problems raw material problems etc. The returns represent the y-axis while the level of risk lies on the x-axis. PyPortfolioOpt is a library that implements portfolio optimization methods including classical mean-variance optimization techniques and Black-Litterman allocation as well as more recent developments in the field like shrinkage and Hierarchical Risk Parity along with some novel.

Each column of X is a time series of returns on a characteristic-managed portfolio. Modern portfolio theory MPT or mean-variance analysis is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. Urban Premium is an asset management.

It has the maximum return portfolio consisting of a single asset with the highest return at the extreme right and the minimum variance portfolio on the extreme left. A use for this file might be a 3rd party vendor who offers energy consulting services and can upload your. Lets get started with Python.

It is a formalization and extension of diversification in investing the idea that owning different kinds of financial assets is less risky than owning only one type. This means you can download your Portfolio Manager electric meter data in the Green Button XML file format See. These are classified as business risks financial risks etc.

The total risk is defined as the total variability of returns which is the summation of systematic and. The market rewards investors with an appetite for risk and on average we expect that higher risk strategies give more revenue. Investors earn abnormal returns months after a firm announces surprise earnings.

An Efficient Frontier represents all possible portfolio combinations. The concept is named after Vilfredo Pareto 18481923 Italian civil engineer and economist who used the concept in his studies of economic efficiency and income. GrowthInvest investments are targeted exclusively at investors who understand the risks of investing in early stage businesses and can make their own investment decisionsPitches for investment are not offers to the public and investments can only be made by members of GrowthInvest on the basis of information.

If we were to approximate the Rayleigh quotient denominators with a constant for example replacing each. As a first step Portfolio Manager has implemented Download My Data for electric meters. At the heart of all our work is the belief that diversification adds meaningful value and that a multi-manager approach can lower single manager risk and increase risk-adjusted returns.

If the first three characteristics are say size value and momentum then the first three columns of X are time series of returns to portfolios managed on the basis of each of these. Prices for stocks before stock splits show on average consistently positive abnormal returns. The built-in financial tool within Portfolio Manager allows you to compare cost savings across buildings in your portfolio.

Intel has consistently generated large profits for years. Which of the following would violate the efficient market hypothesis. CIR markets c1250 products per year.

CIR has developed a unique expertise in sourcing assets with high potential in city centres transforming then packaging them into financial products some of them eligible for tax incentives. Efficient has portfolio solutions for the full range of institutional investors approaching the investment needs of each client personally and uniquely. PyPortfolioOpt has recently been published in the Journal of Open Source Software.

/CapitalAssetPricingModelCAPM1_2-e6be6eb7968d4719872fe0bcdc9b8685.png)

Capital Asset Pricing Model Capm

Mean Variance Portfolio Theory Cfa Frm And Actuarial Exams Study Notes

Modern Portfolio Theory Markowitz Portfolio Selection Model Modern Portfolio Theory Financial Statement Analysis Positive Cash Flow

Modern Portfolio Theory Efficient And Optimal Portfolios The Efficient Frontier Utility Scores And Portfolio Betas

No comments for "An Efficient Portfolio Has Which of the Following Characteristics"

Post a Comment